Save with Your HSA/FSA on Gym & Recovery Equipment

Qualify to Save ~30% by Paying With HSA/FSA

Qualify to Save ~30% by Paying With HSA/FSA

Did you know you can use your Health Savings Account (HSA) or Flexible Spending Account (FSA) to shop at Competitors Outlet? That means you’re not just investing in your health—you’re doing it with pre-tax dollars, saving you~30%*on eligible products.

Why HSA/FSA = ~30% Savings

When you pay with regular post-tax dollars, part of your income goes to taxes before you ever make a purchase. But with HSA/FSA funds, you’re spending before taxes are taken out. That’s why the average person saves roughly 30% when they use their HSA or FSA card. To see your estimated savings, checkout the TrueSavings Estimator.

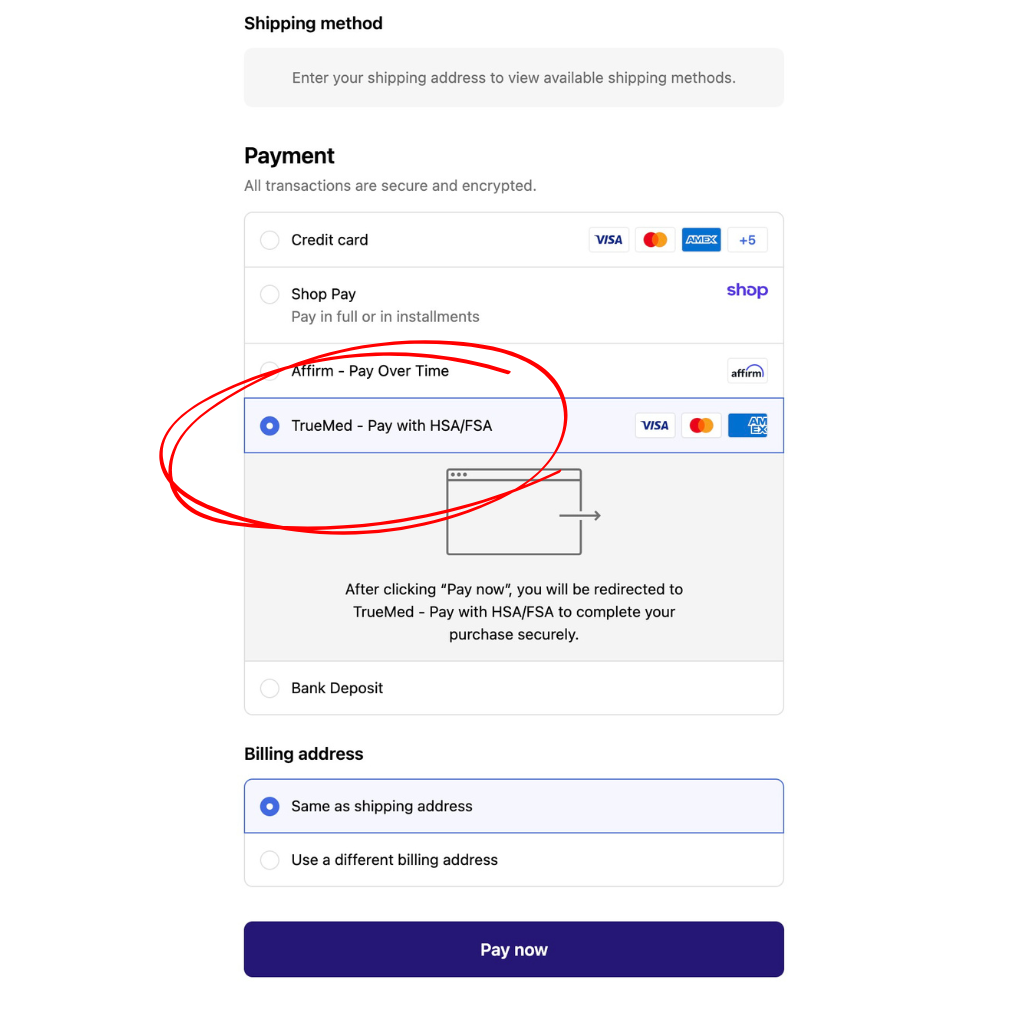

All you have to do is add products to your cart, select TrueMed as your payment option at checkout, enter your HSA or FSA debit card, and take a quick health survey to determine eligibility.

The Truemed payment option determines eligibility and enables qualified customers to pay with their HSA/FSA funds in checkout.

Once you’re approved, that’s it! You’ll receive an order confirmation and effectively save 30-40% on your order!

If you pay with your HSA/FSA card, there's no other work you need to do (we'll send paperwork to ensure compliance). If you pay with your personal credit card, we'll send reimbursement instructions.

Here’s what that looks like:

The steps to using your HSA and FSA funds towards your purchase is easy.

Here’s a step-by-step guide to walk you through the checkout process.

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-free accounts that can be used to pay for qualified health expenses. These accounts are usually set up and managed by an HSA or FSA administrator, and you should have access to said HSA/FSA administrator through your employer (ask your HR department!). HSAs are typically associated with a high-deductible health plan, and funds do not expire. FSAs are independent of your health plan, and funds elections occur in October-November each year for the following calendar year. FSA funds expire every calendar year. Unfortunately, HSAs and FSAs are not available outside of the US, and self-employed individuals (who do not have an HSA from a previous employment) do not qualify for HSAs or FSAs.

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health. An individual can contribute up to $3,850 pretax to their HSA per year, or $7,750 for a family (plus an additional $1,000 if you are at least 55 years old Individuals can contribute up to $3,050 pretax to their FSA per year (with an additional $500 in employer contributions allowed). Almost every qualified individual will save between $1,000 and $2,000, depending on their state and tax rate.

In order to determine whether certain products or services are legitimate expenses for treating, mitigating, or preventing a diagnosed medical condition, HSA/FSA plan administrators often require a letter from a licensed practitioner. This letter is called a “Letter of Medical Necessity.”

Each Letter is valid for 12 months before it needs to be renewed.

Yes! You can use your HSA/FSA card. Once you pay with your card and complete the survey, all you need to do is keep an eye out for the Letter of Medical Necessity that we will send you, and hold onto it for the next 3 years.

Yes! You can use your HSA/FSA card. Once you pay with your card and complete the survey, all you need to do is keep an eye out for the Letter of Medical Necessity that we will send you, and hold onto it for the next 3 years.

Generally, it takes 24-48 hours. If you aren’t seeing your letter in your inbox, check spam, then reach out to TrueMed at support@truemed.com for help!

If you do not qualify, you can reapply for HSA/FSA spending at a later date.

Yes! You can use your HSA/FSA card. Once you pay with your card and complete the survey, all you need to do is keep an eye out for the Letter of Medical Necessity that we will send you, and hold onto it for the next 3 years.

For most Americans, open enrollment is in the last four months of the year. Simply elect to increase contributions to your HSA or FSA during this time and you can begin shopping with Truemed merchant partners. Starting on January 1st, qualified individuals will be able to spend their entire HSA or FSA amount on products that a licensed practitioner recommends to treat, mitigate, or prevent a specific, diagnosed medical condition. These funds will be pulled from your paycheck, prior to tax withholding, by your HSA/FSA administrator in equal installments through the year.